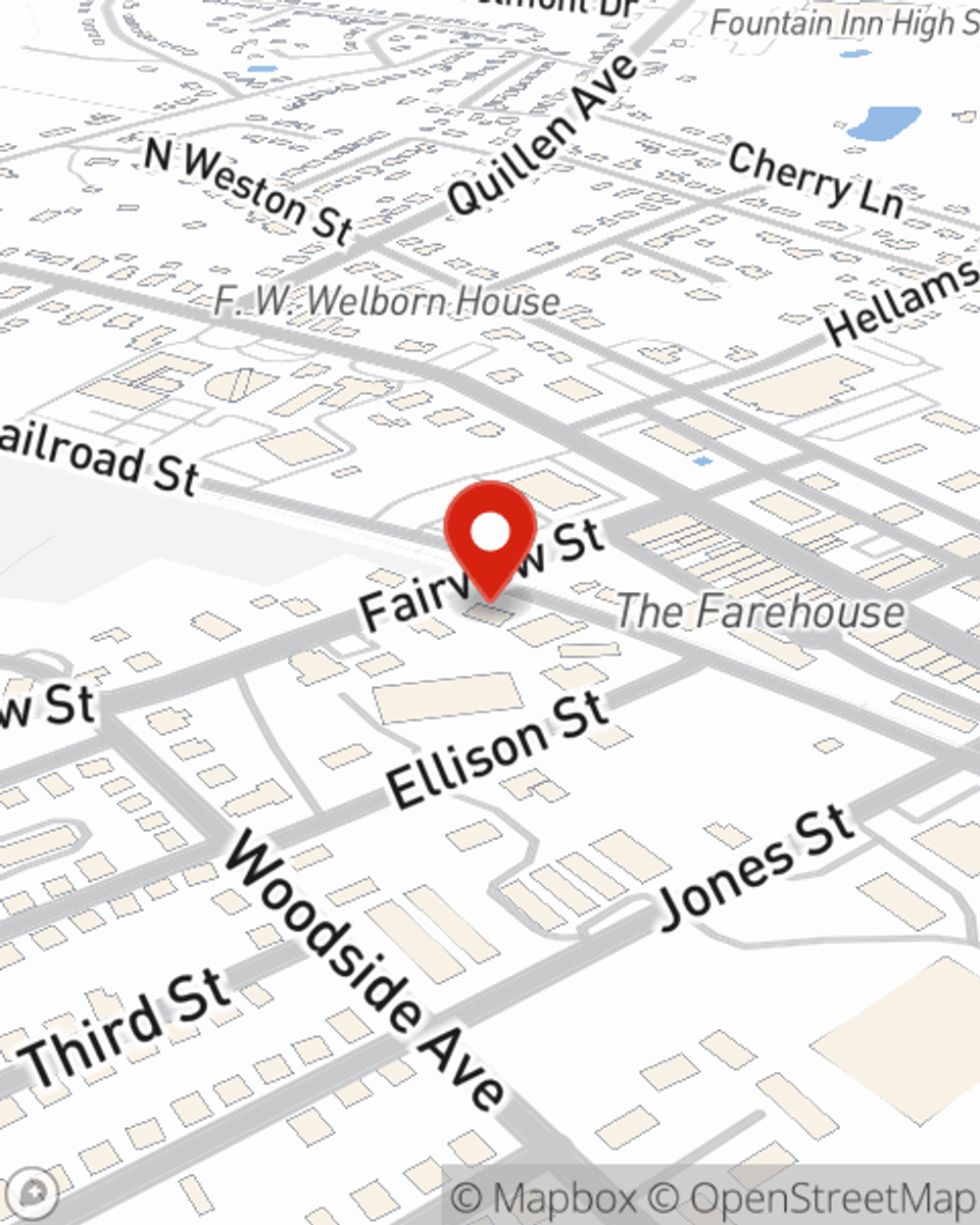

Condo Insurance in and around Fountain Inn

Unlock great condo insurance in Fountain Inn

Cover your home, wisely

There’s No Place Like Home

Things do happen.. Whether damage from weight of ice, fire, or other causes, State Farm has fantastic options to help you protect your condo and personal property inside against unexpected circumstances.

Unlock great condo insurance in Fountain Inn

Cover your home, wisely

Safeguard Your Greatest Asset

With State Farm Condominium Unitowners Insurance, you can be assured that you property is covered! State Farm Agent Anthony Bennon is ready to help you handle the unexpected with dependable coverage for all your condo insurance needs. Such thoughtful service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If if trouble knocks on your door, Anthony Bennon can help you submit your claim. Keep your condo sweet condo with State Farm!

As one of the leading providers of condo unitowners insurance, State Farm has you covered. Contact agent Anthony Bennon today to get started.

Have More Questions About Condo Unitowners Insurance?

Call Anthony at (864) 862-7373 or visit our FAQ page.

Simple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Anthony Bennon

State Farm® Insurance AgentSimple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.